lic jeevan labh (836 premium and maturity calculator) Archives

Using the LIC Jeevan Labh Calculator is simple and user-friendly. Here's a step-by-step guide on how to make the most of this tool: Step 1: Visit the official LIC website or use a trusted online insurance portal. Step 2: Locate the LIC Jeevan Labh Calculator on the website. Step 3: Fill in the required details, including the sum assured.

7+ Jeevan Labh 836 Maturity Calculator SaeidAraya

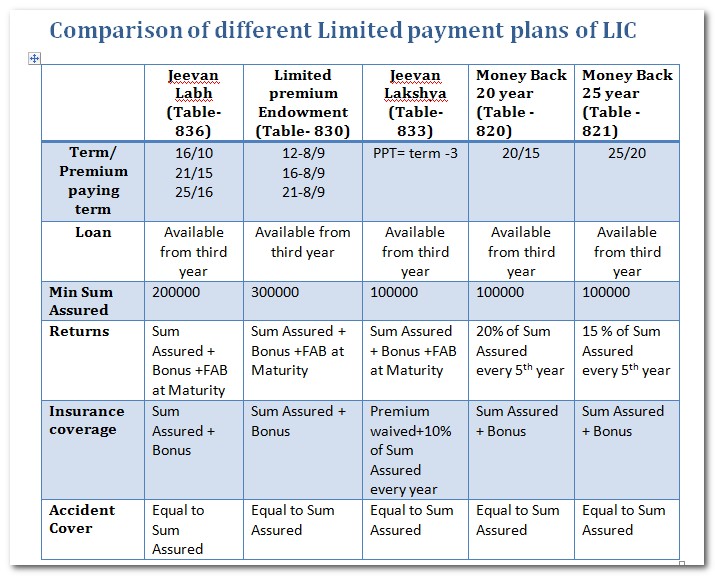

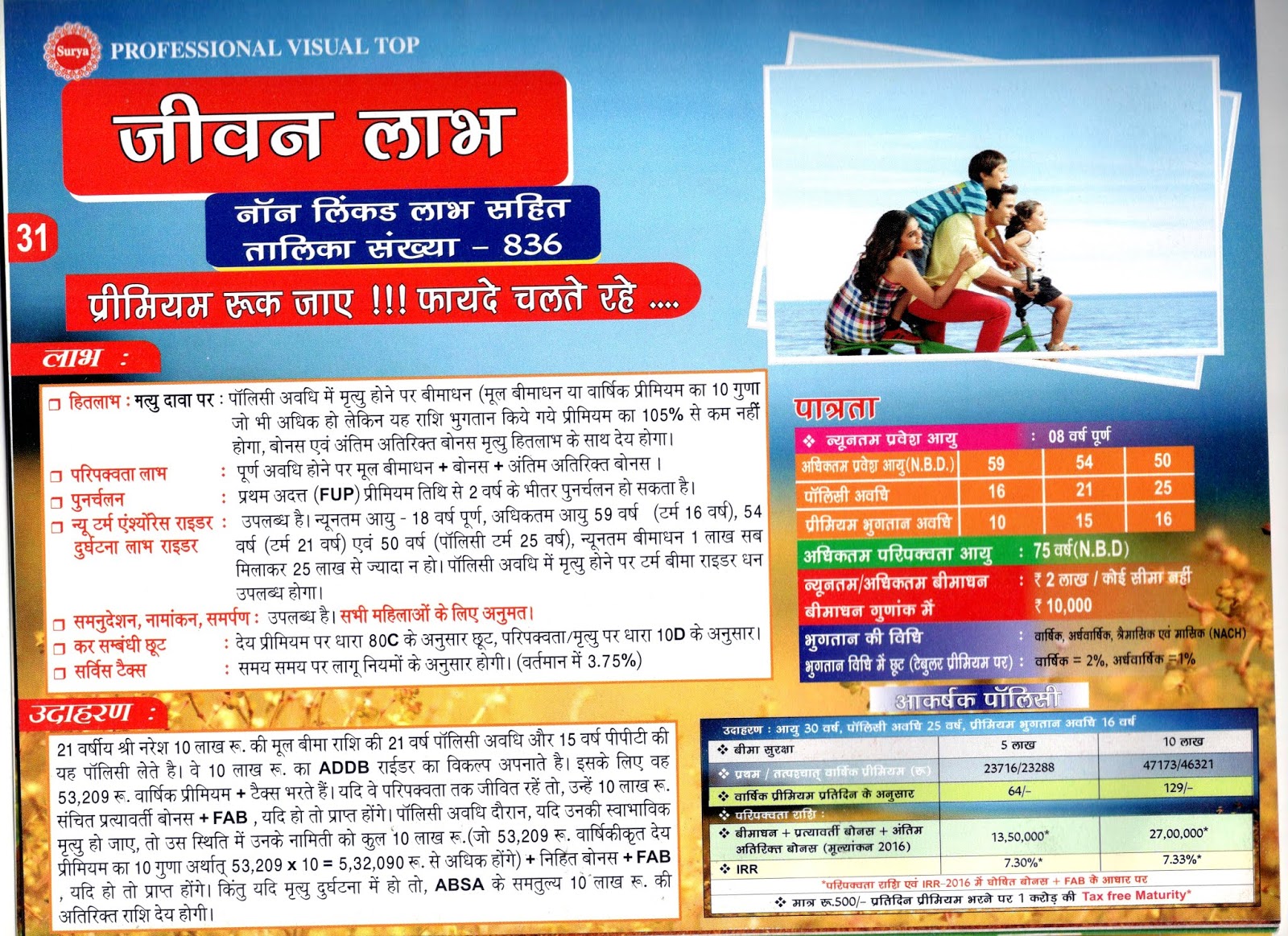

The Lic Jeevan Labh 836 Plan is a non-linked, limited premium endowment policy that provides both financial protection and savings benefits. It offers policyholders the opportunity to secure their family's future while building a corpus for various financial goals. Features of Lic Jeevan Labh 836 Plan

JEEVAN LABH Table No 836 New LIC Plan New LIC Plans Policies

How the plan works: Step 1: Pick a premium amount to pay, depending on the coverage you require. Step 2: Choose a premium paying mode. Step 3: Pay regular premiums for the appropriate duration, based on the Sum Assured option chosen: - 10 years for a policy term of 16 years. - 15 years for a policy term of 21 years.

LIC Jeevan Labh Plan 936

LIC Jeevan Labh (Table No 836) is a non-linked (Not dependent on share market) limited premium paying endowment assurance plan which means premium paying term is less than policy term, for example, for 16 years policy term, premium needs to be paid for 10 years only and maturity will happen after completion of 16 years.

LIC's New Plan Jeevan Labh (Table 836) Review, Benefit calculators, and comparisons. Our LIC

LIC Jeevan Labh - Plan 836 - All details with premium and maturity calculators. LIC's Jeevan Labh (T 836) is an endowment type of plan with limited premium payment period. It is one of the most popular insurance plans and is also considered as one of the best insurance policy from LIC of India.

LIC?s Jeevan Labh Plan 836 Features and Benefits

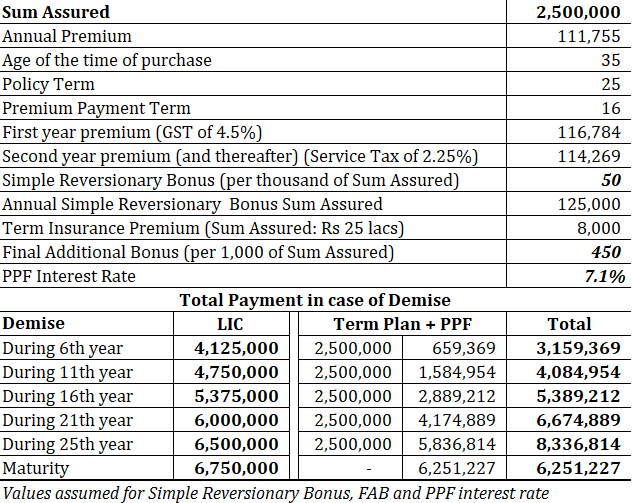

LIC's Jeevan Labh (836) is an Endowment type of plan, where the maturity amount is given as a single lump sum amount after completion of the term. Maturity amount of Jeevan Labh includes Sum Assured, Vested Bonus and Final Addition Bonus (if any).

Lic Jeevan Labh Poster

LIC Jeevan Labh Plan (Table: 936) helps to learn about about this plan by calculating Premium, Approx. maturity and year-wise life covers as per your Age, Term and Sum Assured. Age Policy Term (Premium Paying Term) Year of Purchase Basic Sum Assured Accidental Death & Disability Benefit Rider Premium Waiver Rider Term Rider Terms of Service

Lic Jeevan Labh 836 Premium And Maturity Calculator INSURANCE WORLD

LIC Jeevan Labh Plan (836) Loan Calculator provides ease to calculate year-wise loan amounts during policy term. Following table illustrates calculated loan for a policy with Sum Assured: 5,00,000, Policy Term: 22 Years and Yearly Premium: 24,010.

LIC Jeevan Labh 836 All details with premium and maturity calculators Insurance Funda

Below is the step-by-step procedure for using LIC Jeevan Labh Maturity Calculator: Visit the official website of LIC. From the 'Products' drop-down menu, choose 'Insurance Plan'. On the resulting page, click 'LIC's Jeevan Labh' among the listed products. Under the 'LIC Online Service Portal' menu, click 'Premium Calculator.

125 LIC's Jeevan Labh, Yearly, Age Limit 859, LIC OF INDIA (DMKT) ID 22604394333

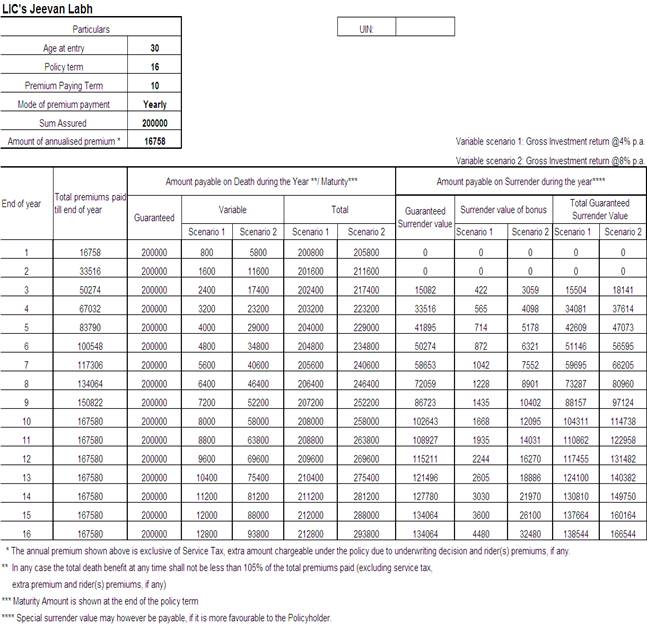

LIC Premium Calculator Jeevan Labh (Table-836) Following premiums are sample and calculated as per parameters given in first table. Please use above calculator to calculate premiums and benefits as per your AGE, TERM and SUM ASSURED (SA). Calculate premium maturity of jeevan labh plan with death claim detail. Premium with necessary riders and GST.

Jeevan Labh Plan (T936) LIC Agent Delhi

LIC's Jeevan Labh Plan (836) is a limited premium paying, non-linked, with-profits Endowment Assurance plan. • Minimum Basic Sum Assured: Rs. 2,00,000/- • Maximum Basic Sum Assured: No Limit • Minimum Policy Term: 16 Year OR 21 Year OR 25 Year

LIC Jeevan Labh Calculator कम निवेश में मिलेगा लाखो रूपए का फंड

You can use this to calculate the LIC Jeevan Labh Plan-836 Maturity Value. The vested simple reversionary bonus rates are per 1,000 Sum Assured. In case you have a plan with Sum Assured of Rs. 5,00,000 - Use the values in the table as following: Bonus Value = Sum Assured / 1000 x Bonus Rate = 5,00,000 / 1,000 x Bonus Rate Simple Reversionary Bonus

lic jeevan labh plan 836 maturity calculator Talkaaj

For the current plan, here is my premium details as per policy document. Basic Premim - 14168 +GST 638Total Premium - 14806 Now NEXT DUE PREMIUM AMOUNT. Insurance21 Wrote : 26-01-2018 19:59:12. Currently, GST rate is 4.5% for first year premium and 2.25% for subsequent year premiums for jeevan labh plan.

7+ Jeevan Labh 836 Maturity Calculator SaeidAraya

LIC Jeevan Labh Endowment Plan Premium and Maturity Calculator - LIC Jeevan Labh Plan 836 is an endowment policy recently introduced by LIC of India on January 1st, 2016. LIC's Jeevan Labh Endowment Plan is available to the customers from January 4th, 2016.

There is no LABH in LIC Jeevan Labh (Plan 936) My Blog

LIC's JEEVAN LABH (836) PLAN UIN: 512N304V01 This is limited premium paying, non-linked, with-profits endowment plan which offers combination of protection and savings. Maturity Benefit: "Sum Assured on Maturity" equal to Basic Sum Assured, along with vested Simple Reversionary bonuses and Final Additional bonus, if any, shall be payable in.

Jeevan Labh (836) Subhash Chand Life Insurance Advisor

LIC Premium Calculator Jeevan Labh Plan (Table-936) Jeevan Labh modified plan (936) has premium paying term of 10, 16 and 16 years. Calculate Premium and maturity as per latest bonus rate. Jeevan Labh has accidental, term rider, premium waiver benefit. Calculate benefit with all riders.